As a creative professional, your focus is on transforming spaces and bringing client visions to life. However, running a successful interior design firm requires a keen eye for aesthetics and a sharp business acumen. The financial management of your business is the structural frame that supports your creative endeavors and ensures long-term profitability and growth.

Navigating the financial side can be complex, especially when it comes to taxes. A critical yet often confusing area is understanding and correctly managing sales tax for interior designers. This guide provides a clear roadmap to the essential accounting and tax principles you need to master to ensure your long-term growth.

Why is Accurate Accounting Important for Interior Design Businesses?

It is no surprise that some parts of a business are complicated and, well, a little bit boring. Unless you started a professional accounting firm, you likely have not planned on spending time and energy sorting through invoices, receipts, purchase orders, bank statements, and all of the other financial documents that are essential to store and track.

Proper accounting practices are not only essential for the financial health of a business and longevity, but they are also a matter of legal compliance. Failing to document and pay all taxable income or transactions can put your business at risk of overdue bills, resulting in fines, audits, lost business, and more.

Our goal isn’t to scare you, it’s just to emphasize that understanding how sales tax for interior designers impacts your business is critically important. Additionally, these tax and accounting issues are crucial to understand and follow no matter what stage your business is in, from startup to an established company.

Let’s set aside all of the other aspects of accounting and focus specifically on the taxes that could be (and likely are) relevant to your interior design company:

Sales Tax for Interior Designers

As an interior design firm, much of your billing likely results from time spent working on projects according to an agreed-upon rate (i.e., billable hours). This is particularly true if you focus on e-design service packages. However, many interior designers also help clients with sourcing and procurement of items, and this can provide an additional revenue stream. This is a key area where understanding sales tax for interior designers becomes crucial.

Interior designers are eligible to purchase items at wholesale prices from manufacturers and then resell them to clients. However, the wholesale purchase is not usually subject to sales tax. For example, if you purchase a light fixture from a manufacturer for $500 at a wholesale price then turn around and sell it to the client for $750, that means you made a profit of $250 on that sale.

But, you are not actually the end-user of the light fixture, and the end-user is the individual typically responsible for paying sales tax. Thankfully, there are some simple ways to avoid paying sales tax to vendors by registering as a valid reseller.

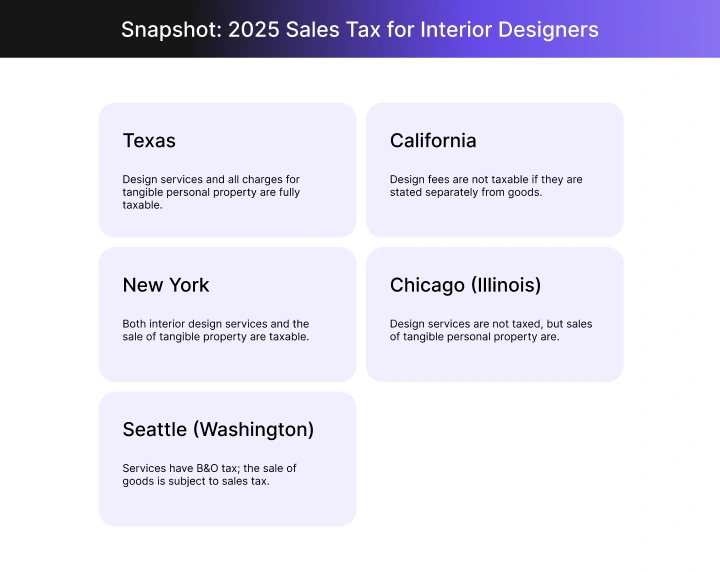

Below we break down exactly why and how sales tax applies to interior designers. It is important to remember that as of 2025, these taxes and the applicable rules vary on a state-by-state basis, so you will need to refer to official government guidance for your specific region.

Read also – How To Stop Losing Money in Your Interior Design Business?

1. What is sales tax?

Sales tax for interior designers is an additional cost levied on goods and services when the end-user purchases them. Sales tax does not apply to transactions where there is no sales of tangible personal property. Accordingly, professional service transactions are not subject to sales tax. To reference our example with the lighting fixture, there would be no sales tax on billable hours spent helping the client pick out the lighting piece if your contract does not determine the service fee based on a markup over the cost of goods.

But there would be sales tax to collect on the sale of the fixture. Any exchange in which personal property is purchased (i.e., the sale of tangible personal property) is subject to sales tax. As of 2025, many states have updated their guidelines on interior design sales tax, with special attention to digital services and hybrid service/product offerings.

Interior design fees that are based on a markup over goods are also subject to sales tax. Once the item is sold to the end-user (e.g., your client), that party is responsible for paying sales tax. The state government will audit records of companies that have unclear records around the payment of sales tax if certain services and goods have been sold, or if an ineligible exemption has been claimed.

Read also – Pricing Strategies for Interior Designers

2. Why do interior designers pay sales tax?

Situations where designers would be responsible for collecting and remitting sales tax for interior designers include:

- If your design fee is based on a markup of goods, it will be subject to sales tax.

- If your services are directly tangential to products that are sold as part of an interior design project.

Situations where designers would not pay sales tax:

- You would not normally have a tax liability for merely procuring the item for a client and passing the cost through on an invoice. Why isn’t this subject to sales tax? Because you’re not the end-user. However, you will need to determine if you have provided taxable services to the client in the procurement process.

However, you will need to determine if you have provided taxable services to the client in the procurement process. While some interior designers opt always to pay sales tax on behalf of their clients and then pass the cost through in the final bill, experts recommend not paying sales tax on behalf of clients because it can make final calculations difficult and is not truly how sales tax was designed to work. Instead, separate taxable items from the total charge on your invoice to the client (highlighting tax due, as this is an additional expense).

Read also – Lead Generation for Interior Design Business

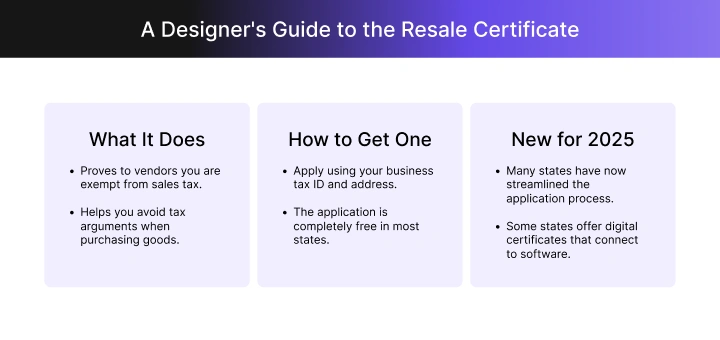

3. Obtaining a Resale Certificate

A resale certificate is the easiest way to prove to vendors that you are not responsible for paying sales tax for interior designers when an item is purchased. Otherwise, you may find yourself engaged in arguments about sales tax each time you attempt to purchase directly from vendors.

To be granted a resale certificate, you will need some basic information, like a business tax ID and address. In most states, the application for a resale certificate is free. For 2025, many states have streamlined their resale certificate processes, with some offering digital certification options that integrate with accounting software.

4. How to Calculate Sales Tax for Interior Designers?

Determining the correct amount of sales tax for interior designers can seem complex. How can you determine to which entity taxes are owed and the total amount? There are a few basic rules to follow, and these are primarily concerned with the location from which the item was purchased and where the client site has a physical presence (as local taxes can sometimes be difficult to ascertain):

- If you buy an item in the same state as a client site, use your resale certificate to avoid paying sales tax.

- If you buy an item in a state outside the location of your client’s site, make sure that tax is paid at the appropriate rate to that government. If you accidentally pay sales tax to the wrong entity or find out that your services are tax exempt, you can apply for a rebate.

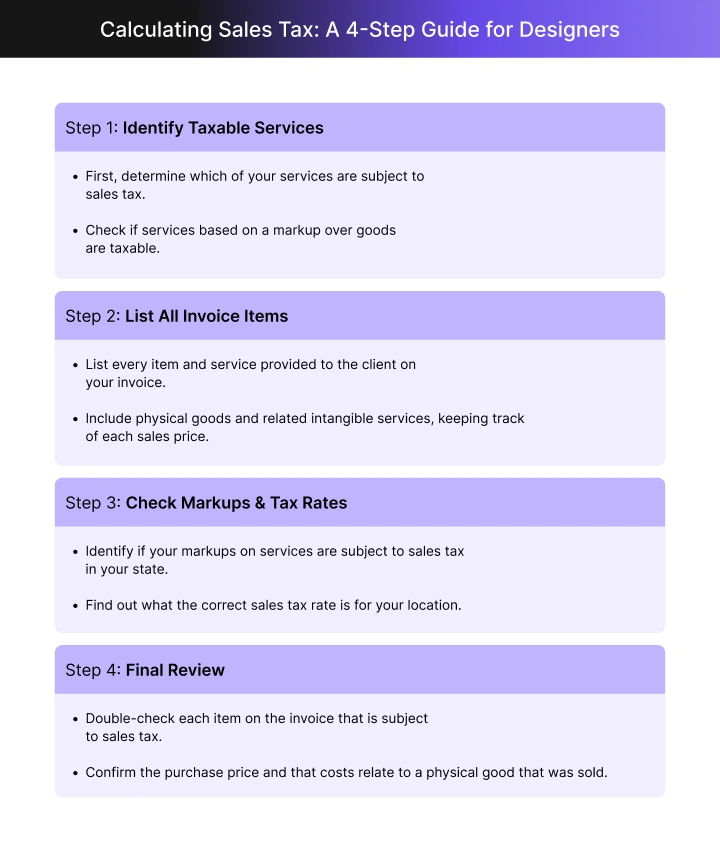

Calculating how much tax you owe. It’s impossible to give advice that applies in every US state (state sales tax guidance varies significantly). However, when calculating what taxable sales apply in your specific scenario, follow these guidelines:

- First, determine which services are subject to sales tax for interior designers. Are your services based on a markup over goods (e.g., is your fee one lump sum that includes costs for items, installation, delivery, services, etc.)?

- Second, list out each item in your invoice that has been provided or purchased as part of the sale and your services to the client, including physical goods and intangible services related to those goods (keep track of the sales price for each item). If you also operate as a retailer, then this would also include retail sales.

- Third, identify if your markups on services are subject to sales tax for interior designers. In other words, is the additional cost that you add to an item or service subject to tax in your state (or the state of the client site)? Also, find out what that sales tax rate is. Obviously, this is where excellent record-keeping becomes essential. For example, if you supervised an installation of items that you procured, make sure you identify which of those fees is subject to tax by checking state regulations.

- Finally, once you have identified each item in the invoice that is subject to sales tax, double-check the purchase price and that the additional costs are directly related to a physical good or real property that was sold. This could save you time and save your client money, depending on how your interior design services are taxed.

Read also – How To Find Your Niche As An Interior Designer?

Income Taxes for Interior Designers

All revenue generated by your company is subject to some form of taxation, whether you are a sole proprietorship and the business’ revenue is taxed as your personal income would be (when you receive a tax return), or you incorporate with a different legal status. In general, the legal structure of your business will determine how much you owe in taxes.

Tax advisors have differing opinions on which corporate structures work best, but these opinions typically depend on whether or not you have employees, not necessarily on tax law.

Read also – How To Revive Your Interior Design Business Post-COVID-19?

Essential Accounting Basics Beyond Sales Tax

Managing sales tax correctly is vital, but so is a firm handle on your overall financial picture. Here are the essential accounting basics every interior designer must master for long-term success.

Why Accurate Accounting is Non-Negotiable?

Beyond managing sales tax for interior designers, maintaining accurate financial records is the backbone of your business. These accounting basics for interior designers ensure you have a clear picture of your company’s financial health, which is vital for making informed decisions, securing loans, and planning for future growth. Proper accounting requires you to focus on strategy and longevity along with compliance.

Tracking Income and Expenses

One of the core accounting basics for interior designers is meticulously tracking all income and expenses. This includes client payments, vendor bills, software subscriptions, and travel expenses. Using dedicated accounting software can simplify this process, helping you categorize transactions, monitor cash flow, and prepare for tax season efficiently. This detailed record-keeping is fundamental to understanding your profitability.

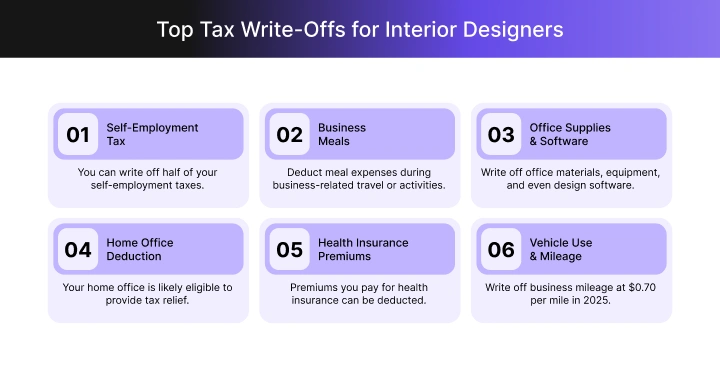

Best Tax Write-Offs for Interior Designers

It might not seem fair that the government takes so much of your hard-earned money! But, there are actually a lot of ways that your legitimate expenses can save you money. You can write off qualified expenses and these will significantly reduce your tax burden. What kinds of expenses are eligible for tax write offs? The most common expense categories, including those that apply to self-employed business owners, are listed below:

- Self-employment tax: The taxes you pay for…paying yourself? Half of these taxes can actually be written off! You shouldn’t be a taxpayer twice.

- Meals: Many expenses for food or other functions incurred during travel or any activity conducted on behalf of the business can be deducted.

- Office supplies: All of the materials, equipment, software, and myriad other tools (including design software) that you use for normal business operations are eligible to be written off.

- Home office deduction: While the rules for calculating home office deductions have changed, if you use your home as your primary workspace, it’s likely eligible to provide some amount of tax relief.

- Health Insurance Premiums: Eligibility varies, but if you pay your own health insurance premiums as an employer, this can qualify as a tax deduction.

- Vehicle Use & Mileage: If you spend any time commuting to client sites, or even making trips that are necessary for business purposes, each mile you drive can be written off at $0.70 per mile in 2025– this adds up quickly!

Read also – 12 Expert Tips To Get Clients for Interior Design Business

Payroll Taxes for Interior Designers

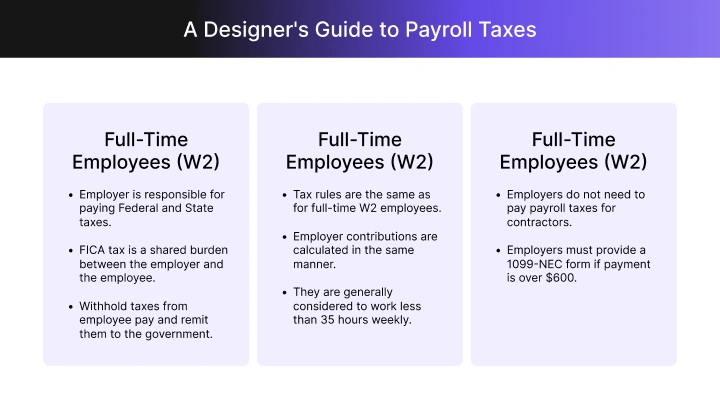

Businesses can hire multiple types of employees to work with them, and these relationships can be full-time or part-time. The most common types of employees or freelancers are:

- Full-time, permanent employees (W2): If you have hired full-time employees then you are responsible for paying Federal and State taxes plus FICA and FUTA obligations. FICA is a shared burden between the employer (you) and the employee, while Federal and State taxes are simply withheld from the employee’s pay and remitted to the government every quarter. The total tax burden for the employer and employee depends on their income level as the tax rate varies depending on total earnings.

- Part-time employees: Employees who work less than 35 hours per week are (generally) considered to be part-time. Even though they earn less than those who work full-time, part-time employees are still required to pay Federal, State, and FICA taxes as outlined above. Your employer contributions will be calculated in the same manner as they would be for full-time employees.

- Contractors (1099): Outside of providing a 1099-NEC to freelancers (i.e., subcontractors like interior decorators, construction contractors, etc.) for whom you have paid more than $600, employers don’t need to pay payroll taxes for outsourced employees.

Read also – 20 Best Client Presentation Tips for Interior Designers

State-by-State Sales Tax Rules for Interior Designers

The rules regarding sales tax for interior designers vary significantly from state to state. Some states tax design services, while others only tax the sale of tangible goods. This complexity makes it vital to understand the specific regulations in the states where you operate.

7 Best Practice Tips To Manage Tax for Interior Designers

By implementing the following best practices, you can confidently manage your firm’s tax obligations and preserve more of your hard-earned income.

- Document every single financial transaction for tax purposes. There are multiple benefits to obsessive documentation, and these benefits are substantial.

- More accurate reporting

- Higher quality records

- Efficiency in the tax preparation process

- Be consistent with your process for covering sales tax for clients. Stick with one procedure for passing sales tax to your clients, rather than attempting to make the transaction more convenient for them. There are companies who are adept at calculating and paying the sales tax cost on behalf of their customers (e.g., car dealerships in many states).

- Get your resale exemption certificate, and get resale certificates in any states where you will be conducting business on behalf of a client (e.g., New York State).

- Hire a tax professional to assist you with difficult or complicated issues. This is far preferable to sorting out an issue later on when the IRS is conducting an audit.

- Purchase or subscribe to a simple accounting software that will allow you to track invoices, purchase orders, business expenses, inventory, and any other assets, expenses, or income that is related to your business. This will provide a detailed record that a tax preparer can use to help you estimate, plan for, and make needed tax payments.

- Make sure that you include sales tax in your estimates, or be clear with clients on exactly which services and items will be subject to sales tax so they aren’t surprised by a significant addition when the invoice is due. If a project is tens of thousands of dollars in total and many of the services and products are taxed, this could add thousands of dollars in additional expense for the client.

- Plan for tax payments from your very first invoice. We recommend at least meeting with a tax preparation specialist so they can help you estimate exactly what you should be withholding (saving) for your quarterly tax payments. Accurate estimates can help prevent a large, surprise bill from the IRS.

Taxes may feel complicated at first, but with the right tools and expert support, you can establish a process for estimating, collecting, and paying taxes with accuracy. Even better, as you keep close track of your deductible expenses, you’ll learn how to take advantage of write-offs to preserve more of your hard-earned income!

Start a Successful Interior Design Business With the Right Software

Having the right business tools makes every stage of the interior design process manageable and efficient. A comprehensive interior design software like Foyr Neo can streamline your design workflow, from initial concept to final presentation, saving you valuable time and resources.

Foyr equips you with the features needed to bring your creative visions to life with stunning clarity and professionalism.

- Quickly draw accurate 2D floor plans or upload existing ones, and then instantly convert them into fully editable 3D models.

- Effortlessly furnish your spaces using a simple drag-and-drop interface, making the entire creative process faster and more intuitive for you.

- Access a vast library of 60,000+ render-ready 3D models, from furniture to decor, to populate your designs with realistic items.

- Leverage advanced AI to get automatic furniture placement suggestions, color palettes, and other smart assistance to enhance your creative workflow.

- Generate stunningly realistic 12K renders of your completed designs in just a few minutes to powerfully present your vision to clients.

Explore how these features can transform your design process. Start your 14-day free trial of Foyr today and unlock your creative potential.

FAQs

Do you need accounting for interior design?

Yes, absolutely. Proper accounting is essential for an interior design business not just for legal and tax compliance, but also for financial health, tracking profitability, and making strategic business decisions. Managing the sales tax and accounting basics for interior designers is crucial for long-term success.

What is the tax on home decor?

The tax on home decor is the state and local sales tax applied to the sale of tangible personal property. As an interior designer, when you sell home decor items to a client, you are typically required to collect and remit the applicable sales tax from the client, who is the end-user.

What is the tax rate for interior works?

The tax rate for interior work depends on the state and the nature of the work. If the work is purely a professional design service, it may not be taxable in some states. However, if the service fees are tied to the sale of goods or if the state explicitly taxes design services, then a sales tax rate applies. State and local governments determine this rate and it varies widely.