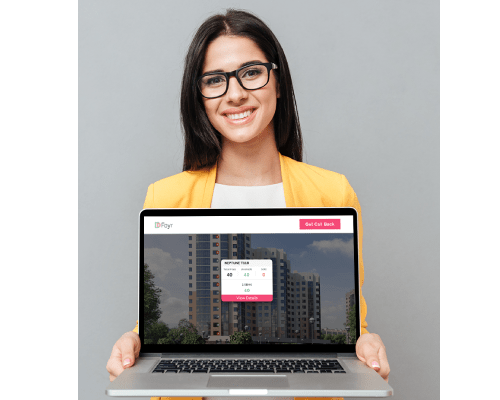

Storyteller

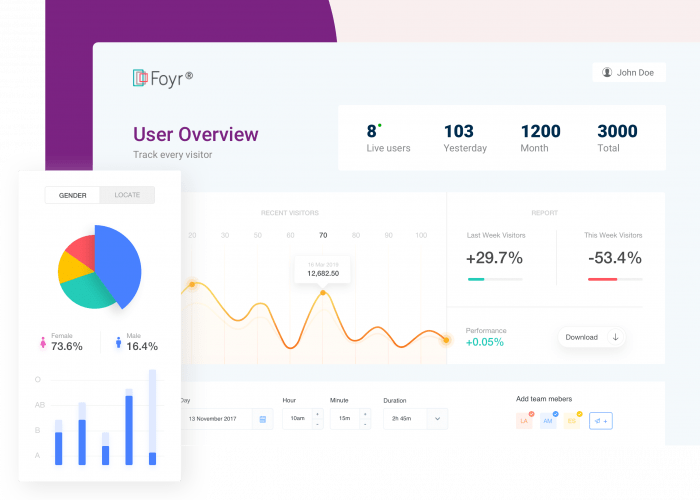

An immersive interactive 360-degree visualization platform that has been much awaited for in the worldwide real estate industry. Rightly addressing the needs of digitally savvy customers, Storyteller provides a comprehensive lead generating and lead nurturing tool for real estate developers.